After posting a pic of my family’s February budget on Instagram, I got some heated messages from some folks. Some of these messages said how I was a terrible mom for allowing my children to live on such a small income and how if I lived in CA instead of GA we would be on streets with our income and how our budget is unrealistic.

So basically, I’m a terrible mom, terrible person, and I should probably just stop posting all together.

But I won’t. I don’t post my family’s budget to boast about our life or how I’m rocking this whole money management thing (because I’m really not).

I post about my family’s real life on a budget because…

- Wanting folks to know that the “b” word isn’t bad and that you can truly live an amazing life on a budget,

- For others to realize that you can make your money work for you and your life and

- I want to give anyone that is lost when it comes to managing money what a family’s actual budget looks like.

The thing is…

I’ve been there. Googling how to make a budget and then finding everything about “recommended percentages” and how to systematically budget but without proper examples, I just always felt lost with it. My hope is that someone will see my family’s budget and something will “click” with them. And they’ll finally be able to put together their own budget.

What my family chooses to prioritize in our budget may not be what your family chooses to prioritize. Guess what, that’s totally okay. We’re different people and we value different things. It would be ludicrous to think our budgets should be identical (which is why I hate those “recommended percentages” budgets).

Take for example one of the messages I got was about eating out. The follower wanted to know why “eating out” wasn’t a line item in our budget. I explained that’s because we rarely eat out. This follower was very surprised by that. They wanted to know how that was possible. The truth is, for my family one of my love languages is food and I LOVE to cook. It’s a passion of mine and serving my family a hot meal is one of the ways that I enjoy showing them that I love them.

That doesn’t mean that they are a bad person because cooking isn’t something they enjoy doing. It means they need to be realistic in setting their budget knowing that there is a probability they are going to go out to eat several times a week. Therefore, they definitely need an “eating out” line item in their regular budget because it’s their lifestyle and there’s no shame in that.

I get it – I’ve been there.

I share this with you because I know how it is. When we see something on social media about someone and it is different than our reality we can, in turn, compare it to our life and make completely inaccurate assumptions.

For instance, someone mentioned that they wish they were as good as me and debt-free. Meaning, they saw our budget and that we don’t have debt payments and then compared that to the stress they’re feeling over their debt payments. Which they then made the conclusion that I’m somehow better than them because I’m debt-free.

Allow me to be clear – I am not better than anyone.

Instead of comparing themselves to me, this follower needs to decide if living debt-free is something that they want and if it is, then how can they go after it. I believe we all need to stop ourselves from comparing our lives to the lives of others we see through our screens.

I just wanted to share this you in case you’re struggling with figuring out a budget or caught in a vicious comparison trap. You have got this. Money is a tool and just like a hammer, you get to decide how it is used. It’s your life and it’s your money, your job is to make your life and money work together. So, if you haven’t created this month’s budget yet, I encourage you to do that today.

If you’ve never created a budget before…

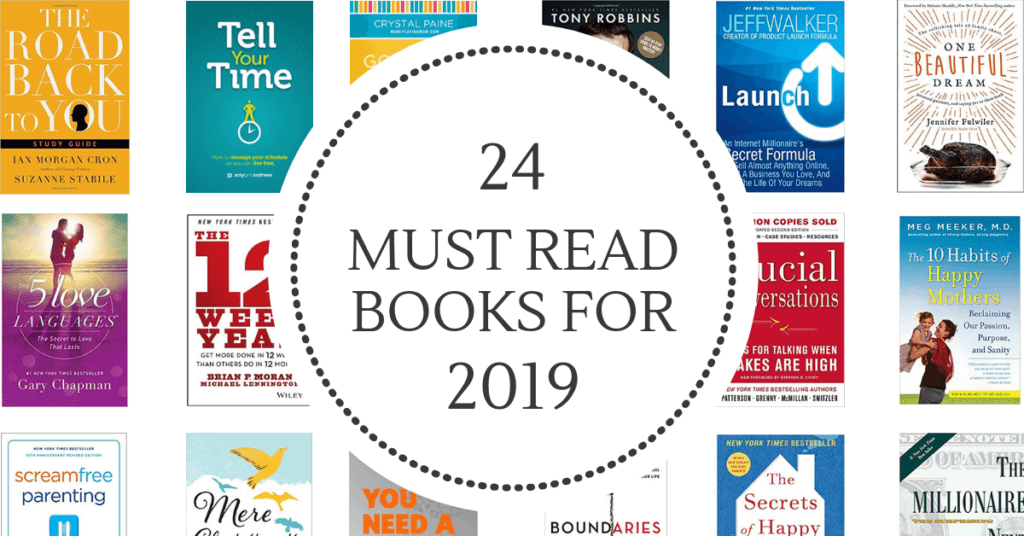

If you’ve read this far and you’re like, “yeah, I’d love to create a budget but I don’t know where to start!” Here are a few places to go to learn more about budgeting.

- Sign up for my free online workshop here. This workshop is less than 30 minutes and I’ll give you a solid starting point for getting a hold of your money.

- Head here to read the Beginner’s Guide to Budgeting – it’s kind of intense so if you’re feeling overwhelmed by this one, sign up for the workshop above. (Remember, there’s no one-size-fits-all model to budgeting, so different strokes for different folks.)

- Head here to read about our “funds” budgeting system that has helped us go from totally lost when it comes to paying for things like Christmas and car-related stuff, to those expenses being no-brainers.

- If you’re married, make sure you read this post here about what-to-do when you’re fighting about money.

OTHER POSTS YOU MAY ENJOY

The post It’s your life – now budget for it. appeared first on Jessi Fearon.